In recent years, online investment apps have taken the securities market by storm. Robinhood, for one, has come to the attention of many securities experts and investor advocacy lawyers. Robinhood is an online investment app that has captured a large population of younger investors through the use of gamification. The app urges users to engage in objectively riskier trades, purchase flashy investments—such as various cryptocurrencies—without much advisement, and it is used to promote trades by sending users a confetti animation upon successful completion of such a trade. Although confetti animations are no longer allowed due to new regulations, Robinhood continues to engage young investors while providing a very limited amount of education on the securities market.

The American education system does not focus on financial literacy in any significant way. Only 21 states actually require some form of financial literacy education and even fewer require this education to be in a designated course. As such, many young investors are not well-versed in the securities market and its many offerings. A recent study by the Financial Industry Regulatory Authority (FINRA) found that 78% of investors aged 18-34 use online investment apps as their trading platform and that 60% of that age group obtains their investment information from social media.

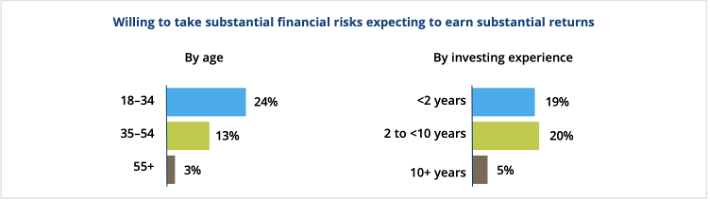

The combination of social media and online investment apps led to what is referred to as “Meme Stock Mania” in January 2021. This phenomenon saw retail investors, heavily influenced by WallStreetBets—a sub-Reddit forum where many young investors get investment advice—buying stocks that were “heavily shorted by hedge funds.” One such stock being GameStop, which saw a 685% surge in 2021. This risky behavior is encouraged by social media and not deterred by online investment apps. Younger investors are more willing to take risks than older investors, which is only encouraged by social media and not deterred by online investment apps.

When a traditional investor speaks with an investment adviser, a certain fiduciary duty exists to inform and protect the investor. Interactions between investment advisers and their clients are regulated by both the SEC and FINRA. Typically, one such interaction between a financial professional and an investor is a conversation regarding risk tolerance and goals. This conversation aims to asses an investor’s willingness to invest in different types of stocks. Robo-advisors also gather information on an investor’s risk tolerance, commonly using a scale from 1-10 during registration, 1 being low risk and 10 being high risk. These roboadvisor sites, such as Fidelity, may also explain who may want to invest in higher-risk stocks and why. When an investor uses an online investment app, like Robinhood, they are not asked what their goals nor risk levels are. This shatters a fundamental layer of protection afforded to more traditional, typically older, investors.

It is becoming increasingly obvious that younger investors need adequate protection from FINRA and the Securities Exchange Commission (SEC). The “confetti regulation” is certainly a step in the right direction, but younger investors with no experience and no regulated influence need even more protection from the various dangers associated with the securities market. Increasing the educational resources in schools and within online investment apps may be the beginning of an important investor advocacy journey. It is important to note that online investment apps, specifically Robinhood and other “no-fee” apps, have greatly expanded the demographics of investors in recent years. Robinhood has eliminated some of the traditional barriers associated with investing but has simultaneously introduced concerns about investor safety.